The Greatest Guide To Estate Planning Attorney

The Greatest Guide To Estate Planning Attorney

Blog Article

Estate Planning Attorney - Truths

Table of ContentsSee This Report on Estate Planning AttorneyEstate Planning Attorney Fundamentals ExplainedExcitement About Estate Planning AttorneyAn Unbiased View of Estate Planning Attorney

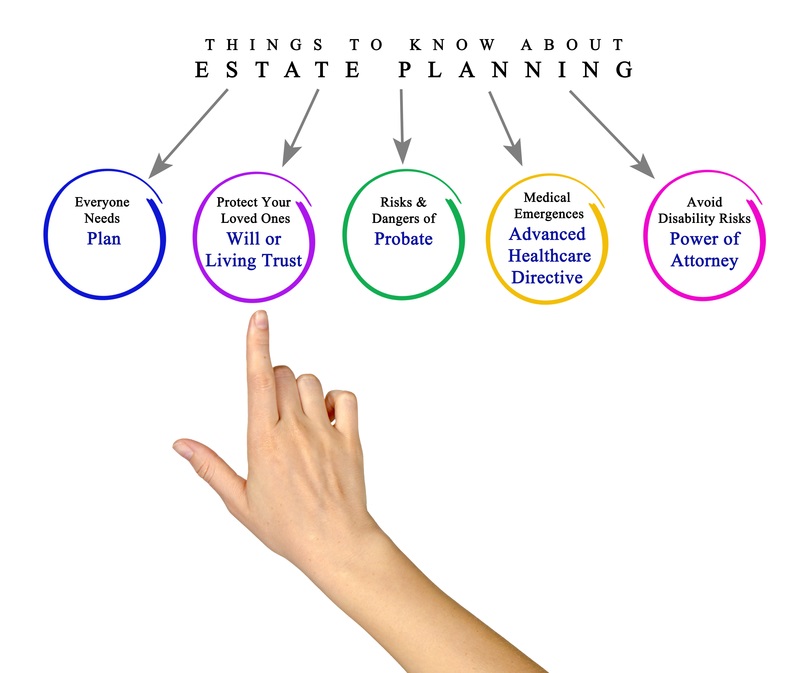

Estate preparation has to do with seeing to it your household understands exactly how you want your assets and events to be taken care of in case of your death or incapacitation. Beginning the process can commonly appear frustrating. That's where estate preparation attorneys been available in. These professionals assist you through the ins and outs to help see to it your wishes will be adhered to.

It's crucial to work with a lawyer or regulation company experienced in estate law, state and federal tax obligation preparation, and trust management - Estate Planning Attorney. Or else, your estate strategy can have voids or oversights. Ask buddies, family, or coworkers for recommendations. You might additionally ask your employer if they use a legal strategy benefit, which can attach you with a network of skilled estate preparation attorneys for a low regular monthly cost.

Having discussions with the individuals you love about your very own passing away can really feel uncomfortable. The structure of your estate strategy starts by believing through these difficult circumstances.

The Main Principles Of Estate Planning Attorney

Whether you're just beginning the estate preparation procedure or intend to revise an existing strategy, an estate planning lawyer can be a vital source. Estate Planning Attorney. You may consider asking pals and associates for referrals. Nonetheless, you can additionally ask your company if they offer lawful strategy benefits, which can aid link you with a network of knowledgeable attorneys for your legal needs, consisting of estate planning.

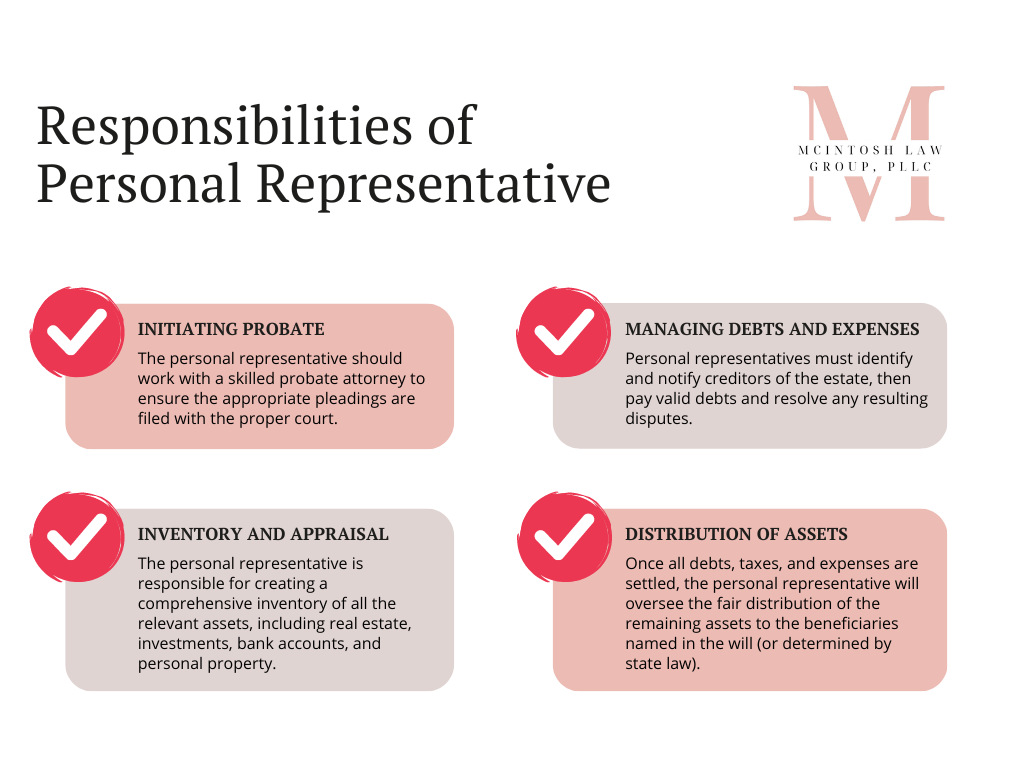

Estate planning attorneys are useful throughout the estate preparation process and after that through the procedure of probate court. They understand the state and government regulations that will affect your estate.

Fascination About Estate Planning Attorney

A great estate planning lawyer may be able to aid you prevent probate court entirely, but that mostly depends on the type of properties in the deceased's estate and how they are lawfully permitted to be moved. In the event that a recipient (or perhaps a private read this article not assigned as a recipient) reveals that she or he intends to object to the will and take legal action against the estate of a dead member of the family or liked one that you also stand to take advantage of, it might be in your finest interest to speak with an estate preparation attorney immediately.

Common lawyer feels typically vary from $250 - $350/hour, according to NOLO.1 The more complex your estate, the much more it will cost to set up., go to the Safety Learning.

The Only Guide for Estate Planning Attorney

They will recommend you on the ideal lawful options and papers to shield your assets. A living count check this site out on is a legal file that can resolve your desires while you're still active. If you have a living depend on, you can bestow your properties to your enjoyed ones throughout your life time; they just do not get accessibility to it until you pass.

You may have a Living Trust fund composed throughout your life time that provides $100,000 to your little girl, yet just if she finishes from college. There are some files that enter into effect after your death (EX-SPOUSE: Last Will and Testimony), and others that you can utilize for wise possession monitoring while you are still alive (EX-SPOUSE: healthcare regulations).

Instead of leaving your relative to think (or say), you must make your purposes clear now by collaborating with an estate planning attorney. Your lawyer will certainly assist you compose medical care directives and powers of lawyer that fit your way of life, properties, and future objectives. The most usual method of staying clear of probate and inheritance tax is with using Trust funds.

If you very carefully intend your estate currently, you might be able to avoid your beneficiaries from being forced right into lengthy lawful battles, the court system, and adversarial family members differences. You want your beneficiaries to have an easy time with planning and legal issues after your death. A correctly performed look at this website set of estate strategies will certainly save your family members time, cash, and a large amount of tension.

Report this page